|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Mortgage Chapter 13: Essential Considerations for HomeownersRefinancing a mortgage while under a Chapter 13 bankruptcy can be a complex process. It's essential for homeowners to understand the key factors involved and how they might impact your financial situation. Understanding Chapter 13 BankruptcyChapter 13 bankruptcy allows individuals to reorganize their debts and create a plan to repay creditors over a three to five-year period. It provides a way to keep your home while catching up on missed mortgage payments. Eligibility for RefinancingTo refinance during Chapter 13, you typically need to have been making on-time payments for at least 12 months. Additionally, approval from the bankruptcy court is required. Steps to Refinance Under Chapter 13

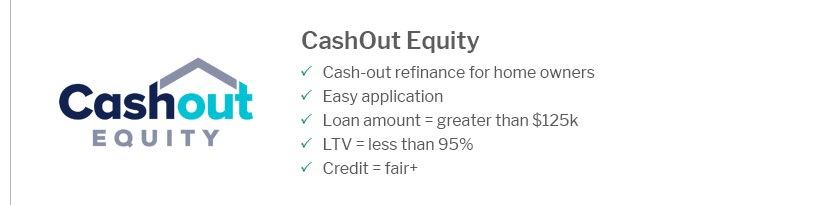

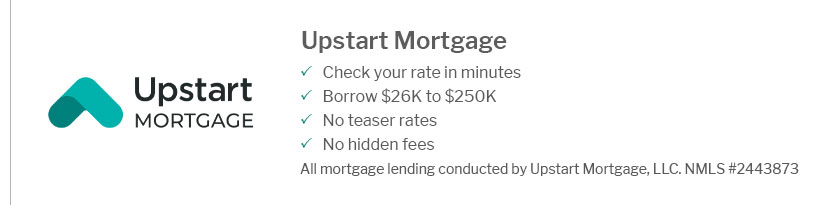

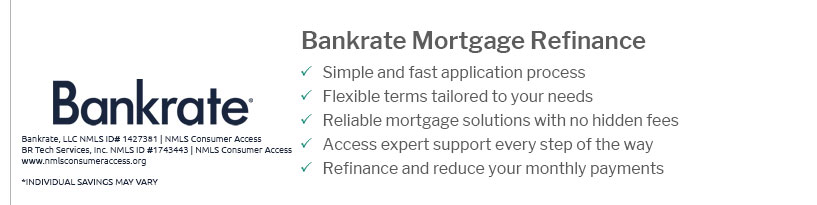

Choosing the Right LenderNot all lenders are willing to work with borrowers under Chapter 13. Consider using a mortgage calculator florida to better understand your potential savings and find lenders with favorable terms. Potential Benefits of Refinancing

Considerations and RisksRefinancing while in Chapter 13 isn’t without risks. It's important to weigh the potential costs and benefits carefully. Keep an eye on home loan refinance rates today to ensure you're making the most informed decision possible. FAQ SectionCan I refinance my mortgage during Chapter 13 bankruptcy?Yes, you can refinance during Chapter 13, but you must have made on-time payments for at least 12 months and obtain court approval. What documents are needed to refinance under Chapter 13?You will need your bankruptcy paperwork, proof of income, and a detailed budget to present to lenders. What are the benefits of refinancing during Chapter 13?Refinancing can help you secure lower interest rates, consolidate debt, and access home equity. https://www.lendingtree.com/home/refinance/refinance-after-bankruptcy/

Yes, it's possible to get a mortgage refinance after bankruptcy. The main caveat is you'll likely face a longer process, as you have to wait up to four years. https://www.jvmlending.com/loan-types/chapter-13-bankruptcy-refinance/

One of the most attractive benefits of refinancing during Chapter 13 bankruptcy is the ability to consolidate your debts. By leveraging the equity in your home, ... https://www.rocketmortgage.com/learn/refinance-after-bankruptcy

Can You Refinance During A Chapter 7 Or Chapter 13 Bankruptcy? ... No. No mortgage lender will make a loan to a debtor who's in the process of ...

|

|---|